Many individuals want to figure out how to calculate mortgage payments on their own. Whether it be because they are looking to purchase a new home or they are looking to refinance, being able to figure out what a mortgage payment could be is important. However, there are a lot of different factors that come into play when calculating the final mortgage amount. To help you along the way, follow the steps below.

Calculate Mortgage Payments Formula

R ? R is your monthly interest rate expressed in decimal form. To determine R, you need to take the annual percentage rate and divide it by 12. Then, you take that number and divide it by 100 to get R. for example, let?s say the annual interest rate is 6.5 percent. You take the 6.5 percent and divide that by 12 to get 0.054. You then take the 0.54 and divide it by 100 to get 0.0054. That is your monthly interest rate.

P ? P is the amount of money borrowed referred to as the principal. If the house sold for $200,000, that would be your principal amount.

N ? N is the total number of payments you are going to make on the loan. If you take out a standard 30-year mortgage, the total number of payments would be 360, i.e. 30 years x 12 payments per year.

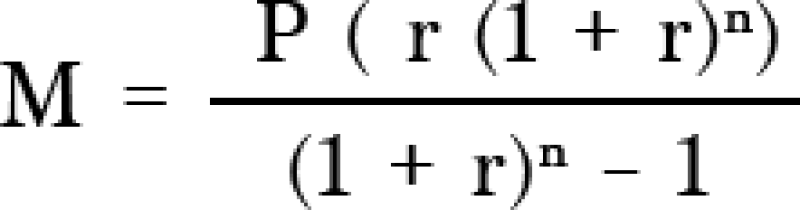

The best way to determine what your monthly payment is going to be is by using the following formula M = P (r (1 + r)^n) / ((1 + r)^n ? 1))

Now, you are going to insert your numbers from our previous calculations to determine the monthly payment amount.

R = 0.0054

N = 360

P = 200,000

M = 200,000 (0.0054 (1 + 0.0054)^360) / ((1 + 0.0054)^360 ? 1))

Next, you have to begin solving the equation. Start by adding the 1 with the R value to get 1.0054. By doing this simple step, you can help simplify the equation and make it simpler to solve. After doing the addition, your sample will look like this.

M = 200,000 (0.0054 (1.0054)^360) / ((1.0054)^360 ? 1))

Now, you need to solve for your exponents. This is done by taking your 1.0054 and raising it to the power of N, which is 360 in this case. You need a calculator with an exponent function. This button normally looks like this xy If you don?t have a calculator that is capable of doing this, you can always use Google to get your answer as well. Type in the 1.0054^(360) and let the search engine do the calculation for you. This will give you the answer of 6.95. Insert that into the equation to get this:

M = 200,000 (0.0054 (6.95)) / (6.95 ? 1)

Now, start by solving the equation even further. Take the 6.95 and multiply it by the 0.0054 to get 0.03753. Then, subtract the 1 from the 6.95 to get 5.95. Now, you are going to take both of those numbers and insert them back into the equation to get:

M = 200,000 (0.03753 / 5.95)

Now, take the top part of the equation and divide it by your bottom part. This means taking 0.03753 and diving it by 5.95 to get 0.00631. This leaves you with this final equation of:

M = 200,000 (0.00631)

For the last step, you are going to multiply the 200,000 by the 0.00631. This would leave you with a monthly mortgage payment of $1,262 for the next 30 years.

Once you have gone through the calculations a few times, the process will become simpler. It is all a matter of inserting the right numbers into the equation and performing the operations in the proper order. In doing so, you can easily calculate your monthly mortgage payment in no time. Using this formula can help you better plan your finances and figure out what you are going to pay out.

If you wanna calculate your Mortgage Payments online use our Online Mortgage Calculator

Leave a Comment

0 Comments

There are no comments... yet!