The liquidity of any business is vital to the person who owns the business and the one who operates it. A simple way to gauge the company’s capacity to survive through economic downturns is by analyzing the cash flow statement of a business.

For those who own a rental of any real estate property, it is essential to know if the cash-on-hand can sufficiently pay for all of the cash expenses. The cash flow statement of a business is an indicator of whether the real estate property is actually earning money or if it is operating in debt.

Cash Flow Statement Analysis

Now that you know how to compute the cash flow statement, it is important that you know what the results imply based on your business.

First, the rental income part of your cash flow statement can be an indicator of whether your tenants pay on time. If the fees for late payment are high, it could indicate that the tenants living on your real estate property pay in a delayed manner. There are also times when you have a significantly higher cash inflow, but this could be due to a high tax savings or if a new tenant made an advance payment. The cash inflow from these transactions are included in the current period since it should be recorded when the payment was made, not when the payment is applied.

Second, the expense section is the section that most owners pay more attention to since it states the amount of money that is being spent by the business. There are instances where the major expenses are paid all at once like landscaping cost so this can contribute to a higher cash outflow, which then leads to a lower net cash flow. There are also instances where the expense section is quite low because there are payments that weren’t made, such as when the utility bill has been left unpaid.

Additional Ratios for Real Estate Cash Flow Analysis

As you can see, there are various factors that can affect the status of your cash flow, but they do not indicate clearly the status of the business based on profitability. There are other computations that you can use to gauge the cash flow standing of your business.

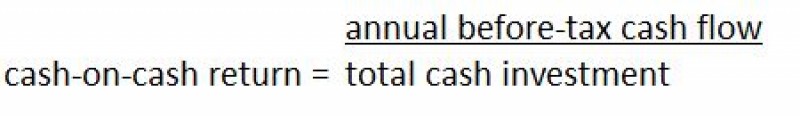

Cash-on-Cash Return

If you want to compute the rate of return of your cash income versus your cash investment, you can use cash-on-cash return formula. It indicates the ratio between the cash flow and the total cash invested, so this formula only takes into consideration the investments that were paid in cash.

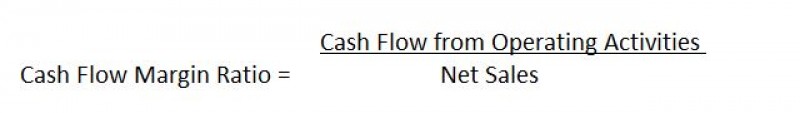

Cash Flow Margin Ratio

The cash flow margin ratio is more than an indicator of liquidity, since it also indicates whether a business can turn their sales into profit. The net sales is the income earned by the company, but the net profit is what actually stays with the company after the operational expenses. So the Cash Flow Margin Ratio is the relationship between the net cash flow from operations and the net sales.

The real estate industry might rely heavily on the appreciation of properties, but if you are running a rental property, it is important to be well-informed about the solvency, liquidity, and profitability of your business. In the end, this will indicate whether your business can still keep up with its operating expenses.

Leave a Comment

0 Comments

There are no comments... yet!